Introduction

There are 7 basic accounting principles every student must know in order to pass accounting class. Why? Because these principles, which are defined in GAAP (generally accepted accounting principles), guide the field of accounting. These principles are so fundamental to the field of accounting that you will see them over and over again throughout your accounting coursework, from financial accounting to cost accounting classes and beyond. So, grab a pen and paper, you’re going to want to take notes!

7 Accounting Principles You Must Know To Pass Accounting 101

Matching Principle

This principle states that you should record a related expense when you record a revenue. This is the foundation of accrual basis accounting and financial accounting.

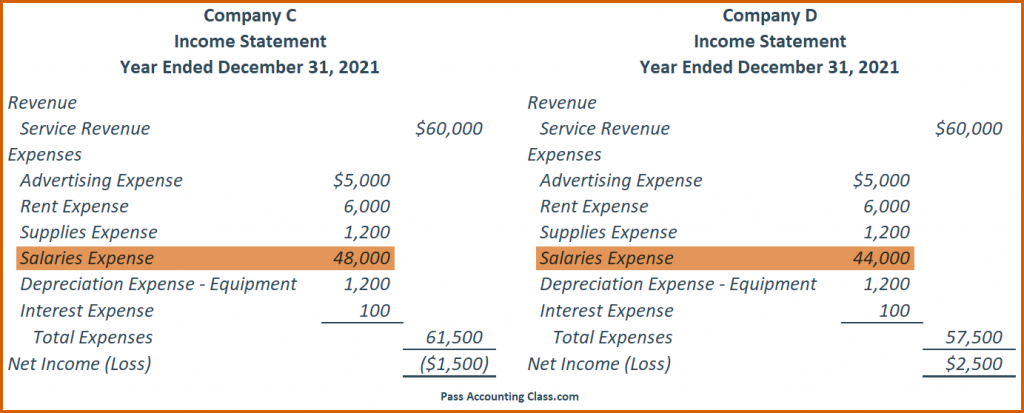

For example, Company C and Company D started business on January 1, 2021, and had identical financial transactions. Salaries Expense total $4,000 per month. Current month’s salaries are paid in the next month. Both companies report $60,000 in service revenue.

According to the Matching Principle, although the salaries for December 2021 will be paid in January 2022, the salaries apply to the Service Revenue that was earned and recorded in 2021. So December 2021 salary expense must be recorded on the 2021 Income statement.

This means that the Salary Expense on the Year-End Income statement will be $4,000/month x 12 months = $48,000.

See the Income Statements for Company C and Company D below. Which company reported Salary Expense according to the Matching Principle?

As mentioned in a previous post here, only Company C recorded the Salaries Expense transaction in accordance with GAAP. Properly stated Salaries Expense and Net Loss result from Company C following the Matching Principle.

Company D only recorded 11 months of Salaries Expense ($44,000 ÷ $4,000/month = 11 months). They only recorded the amount they paid out for salaries. Since December’s salaries are paid in January 2022, they only paid and recorded 11 months of salaries in 2021. Overstated Salaries Expense and Net Income result from Company D not following the Matching Principle.

Revenue Recognition Principle

This principle states that you should record revenue only when it’s been earned, regardless of payment received or not received.

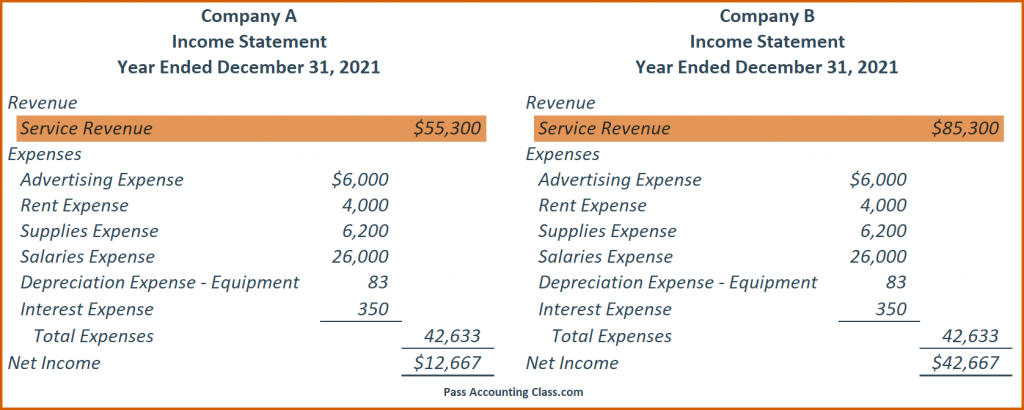

For example, if Company A and Company B have identical financial transactions and each company received $30,000 as payment for future services to be performed next year, would it appear on the current year-end Income Statement or next year’s Income Statement?

Below are the Income Statements for Company A and Company B after receipt of the $30,000.

According to the Revenue Recognition Principle, even though the Service Revenue was paid this year, it won’t be earned until next year, so it should NOT appear on this year’s Income Statement.

In the example above, Company A properly reported the Service Revenue in compliance with the Revenue Recognition Principle.

Company B didn’t follow the Revenue Recognition Principle and didn’t comply with GAAP accounting standards.

Conservatism Principle

This principle states that when there’s an option in reporting a transaction, you should use the option that results in lower asset amounts and/or lower net income.

For example, when a company purchases inventory, they record the cost of that inventory at the price they paid. While the company owns the inventory, if the market value of that inventory falls below the original price paid, an accountant can adjust the value of that inventory below the price paid. However, if the market value of that inventory exceeds the price paid, the value of that inventory will not be increased. Therefore, it’s conservative to have inventory listed below its purchase price.

Monetary Unit Assumption

This assumption states that a business should only record economic events that can be expressed in a unit of currency. For example, if you’re a US company, financial transactions would be recorded in the US dollar. This means that the financial statements for a US company are stated in US dollars.

Economic Entity Assumption

This assumption states that a business is a separate entity from the owners. Since this is the case, the owner’s personal expenses shouldn’t be included in the company’s accounting books. By adhering to this GAAP standard, company financial statements accurately reflect only the company’s business dealings.

For example, if the owner of a company wants to purchase a personal item, the owner should first take a draw or receive a distribution from the company. The draw or distribution reduces the company’s Cash and Equity. Once the owner receives the draw or distribution, the owner can use the funds as they wish.

Unfortunately, small business accounting usually ignores the Economic Entity Assumption. This happens when an owner is unaware of GAAP principles and simply uses company funds to purchase personal items. In accounting terms, this is referred to as co-mingling funds and can make financial statement preparation challenging. Oftentimes, I’ll ask my new small business accounting clients if they’re familiar with GAAP. I know I’ll have more work to do if they respond by asking “what is GAAP?” 🙂

Going Concern Principle

This principle assumes that a business will remain in operation for the foreseeable future. It also means that there’s no reason to assume the company will go out of business. As a result, a company is justified in deferring prepaid expenses to future periods. For example, if a company pays for six months of rent in advance, the company should record it as a Prepaid Rent, an Asset. As the rent is used, the Prepaid Rent account is reduced and Rent Expense is increased.

Cost Principle

This principle states that you should record purchases at the original amount spent to acquire the item. For example, you record a building at the cost when purchased. This amount appears on the Balance Sheet and will appear at the historical cost. Despite appreciation, the building remains at historical cost on the Balance Sheet. It won’t be adjusted to current market value.

That’s it for this post. When learning any accounting terms, it’s important to realize that some classes don’t focus on the term or principle name themselves. Instead, they focus on the concepts associated with the term or principle. The concepts are prevalent throughout the class. Some students learn the terms or principles because the principles are simply standard ways of “doing accounting.” Also, it’s important to learn these GAAP principles as described in your accounting books, as your book may use different names for the generally accepted accounting principles described here.

Learn about the Top 3 Most Difficult Accounting Principles That Stump Students Every Time.

As always, I’m here to help you succeed. I’m here to help you pass accounting class! There’s no need to feel stressed out about running out of time before finishing all the questions on your accounting quizzes and tests. My students efficiently solve accounting problems with confidence in the allotted time. We focus on the information taught in your class: Journal Entries, T-Accounts, General Ledger Accounting, Trial Balance, Adjusting Entries, Closing Entries, Balance Sheet, Income Statements, etc.

Want access to on-demand video tutorials that cover key concepts students struggle with and step-by-step solutions to common homework problems, practice quizzes, and more? Check out our Pass Accounting Class Resources.