Why Take Accounting Classes?

There are two reasons students take accounting classes. It can either be an elective class or a required class for your major. It is rare, but there are some students that elect to take an accounting class. This class is usually thought of as “accounting 101” and is similar to bookkeeping classes with additional accounting education. Taking an accounting class can be rewarding and challenging! Accounting training helps you understand how accountants think and shows you the “behind the scenes” of running a business. Understanding basic accounting principles helps regardless of your major.

Most of the time accounting classes are a requirement for a particular major. A lot of times colleges require even non-accounting majors to take accounting classes. In fact, most business majors require at least one semester of accounting. When I was in school, we had a “core” curriculum we needed to pass in order to be accepted into the business school. To be admitted into the school of business, I needed to take (and pass) two semesters of accounting. Once admitted, I was able to start my business major, accounting.

Most of the students I tutor are in similar situations, and most of them aren’t accounting majors. I work with students that want to major in marketing, finance, management, entrepreneurship, economics, etc. If they don’t pass their accounting classes, they have to change majors. That’s a harsh reality! Fortunately, they reach out to me and we’re able to “right the ship” before it’s too late.

7 Accounting Classes Even Non-Accounting Majors Must Pass

Depending on your college and major, you may be required to pass accounting to complete your degree. Even non-accounting majors were found to have accounting class requirements as indicated in the list below.

a. Liberal Arts Majors: Principles of Accounting 1

b. Business Administration Majors: Principles of Accounting 1 & Principles of Accounting 2

c. Finance Majors: Principles of Accounting 1, Principles of Accounting 2, Intermediate Financial Accounting 1, Intermediate Financial Accounting 2, Accounting Information Systems, Intermediate Management Accounting / Cost Accounting, & Introduction to Taxation

d. Economics Majors: Principles of Accounting 1 & Principles of Accounting 2

e. Entrepreneurship Majors: Principles of Accounting 1 & Principles of Accounting 2

f. Information Technology Majors: Principles of Accounting 1 & Principles of Accounting 2

g. Management Majors: Principles of Accounting 1

h. Marketing Majors: Principles of Accounting 1 & Principles of Accounting 2

What Will I Learn?

Principles of Accounting 1 – This class teaches the fundamentals of accounting. It’s thought of as “accounting 101.” You’ll learn concepts you’d learn in a bookkeeping course and learn about the accounting cycle. Additionally, you’ll learn how to prepare financial statements.

Principles of Accounting 2 – This class builds on the information you learned in Principles of Accounting 1. It focuses more on financial statement analysis and introduces some foundational managerial and cost accounting concepts.

Intermediate Financial Accounting 1 – This class expands on Principles of Accounting 1 and covers accounting theory, accounting principles / procedures, and applying GAAP (Generally Accepted Accounting Principles,).

Intermediate Financial Accounting 2 – This class builds on the information you learned in Intermediate Financial Accounting 1 and covers more complex accounting transactions like accounting for pensions, income taxes, and leases. It also covers additional external reporting concerns.

Accounting Information Systems – This class is an essential in today’s fast-paced technological environment. Most businesses use some type of software to record transactions and this class focuses on information systems and their related subsystems.

Intermediate Management Accounting / Cost Accounting – This class emphasizes management tools that allow users to measure progress. The focus is on managers and their use of the financial and operational information.

Introduction to Taxation – This class focuses on federal income tax for individuals and corporations.

What Are Accounting Classes Like?

Most students agree that accounting courses are challenging. Usually, your first accounting course is going to be the most challenging. This is because accounting courses are different than other courses and they take some time to get used to.

Your first accounting course starts off like any other course where you need to learn certain terms and concepts, but then it gets more complicated, quickly. How you respond to this sudden change determines if you’ll do well in the class. You want to establish successful habits immediately because as the class progresses, the difficulty increases.

I often tell my tutoring students that accounting class is like a math class and foreign language class combined. Each chapter builds on the next chapter. So, you want to master the first chapter and then move on to the next chapter. It takes time and can be frustrating, but it’s the best way to learn the material. I’ve seen students skip the early chapters / fundamental concepts and then wonder why they’re struggling with concepts later in the class. When I work with them, we revert to the fundamentals and their grades improve.

Subsequent accounting courses are not necessarily easier, but you won’t experience the “culture shock” like you did in your first accounting class.

What Can Make Accounting Classes Especially Challenging?

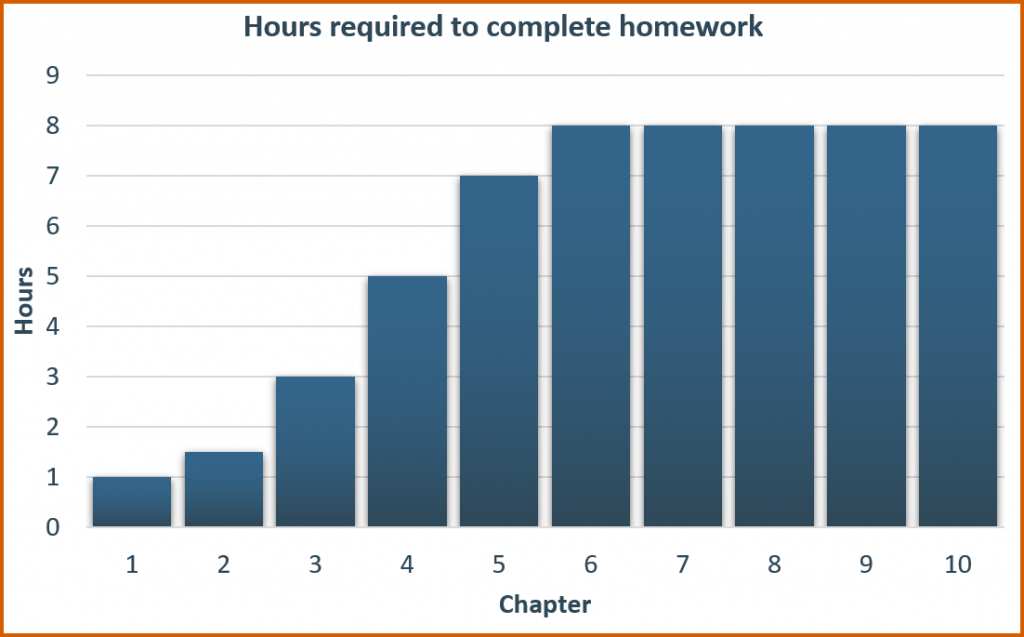

In addition to weathering the culture shock, time management is another key to success. Realize that in your first accounting class, the time allotment for homework will increase and then plateau. A lot of the students I work with initially struggle with the time requirements related to homework. See the image below as an example.

Often, students think accounting class will be easy because chapter 1 homework doesn’t take them a long time to complete. This sets a false expectation. Chapter 2 homework takes a little longer and then chapter 3 homework takes twice as long as chapter 2 homework. Chapters 4 & 5 take even more time but eventually, the amount of time it takes to complete the homework plateaus. A lot of students don’t plan for this rapid increase in the time it takes to complete the homework and it catches students off guard. Plan accordingly.

Another key to success is practicing test questions. Test questions are designed to be tricky and confuse students all the time. Your homework questions are usually long form while test questions tend to be short answer or even multiple choice. Test questions require more attention as they’re asking a lot of information in what, deceptively, appears to be a very simple question. Test questions can be mastered. I focus on teaching methods that help students solve even the most challenging accounting problems efficiently and with ease.

Finally, some colleges have popularized accounting classes online. While I feel this is a great use of technology, most of these classes lack a physical textbook. The textbook is usually online which makes it nearly impossible to highlight or bookmark. If your college participates in accounting classes online, I highly suggest you purchase / rent a physical textbook. It may not seem like a big deal, but it will help you out immensely when trying to navigate between concepts.

I’m here to help you succeed. I’m here to help you pass accounting class! There’s no need to feel stressed out because there’s never enough time to finish all the questions on your accounting quizzes and tests. My students efficiently solve accounting problems with confidence in the allotted time. I want to show you how to do this with my Pass Accounting Class program.

My Pass Accounting Class membership program is monthly (month to month), features video training lessons with learning materials, has a private message board where you can ask me your questions, and offers discounted rates for one-on-one tutoring sessions with me. Use the membership as long as you need and cancel anytime. Use the coupon code ” halfoff ” to get your first month half off! Click the button below to enroll!