Why Practice Accounting Questions?

One of the best ways to study accounting is to do the homework problems. An even better way to study accounting is to practice accounting questions you'd see on your test or quiz. Here's why: homework problems are designed to take you step-by-step through the process of solving the problem. This helps build a foundation for solving these types of problems. Unfortunately, the format of the homework problems is usually different than the questions you'll see on your tests and quizzes. Additionally, your test and quiz grades are typically weighted heavier than your homework grade. So, doesn't it make sense to spend time on questions that best resemble what you'll see on your accounting tests and quizzes?

Prior to working with me, most of the students I tutor do well on homework but struggle on tests and quizzes. The main reason is that the format of the test or quiz questions confuses students. This inevitably results in poor grades and undermines their confidence. Maybe you can relate? It's a cycle that is hard to overcome without help. Fortunately, there's an easy solution!

When students start working with me, we focus on solving accounting practice questions. These questions change how you think about accounting and change your approach to answering the questions you'll see on your accounting tests and quizzes. Imagine not being stressed out while taking your test! You'll become more efficient at answering these questions correctly, so you'll feel calm, and confident while taking your test.

Practice Quizzes to the Rescue!

Practice doesn't make perfect. Perfect practice makes perfect! Accounting is like math; there's a right answer, many wrong answers, and no gray area (areas for interpretation). The answer is either right or it's wrong, period. This is why most questions on Accounting tests and quizzes are multiple choice or short answer. Since this is the case, it makes sense to practice these types of questions. Additionally, it's a good idea to practice a group of questions in a timed situation. This emulates your testing environment. It forces you to become more efficient at answering these questions. Use a timer app on your phone/computer while practicing these questions. The quicker you can correctly answer these questions, the more confident you'll become and the calmer you'll be. This trains you to be calm and confident for your test or quiz!

When taking accounting practice tests or quizzes initially focus on answering the questions to the best of your ability. Don't worry about getting the right answer, focus on understanding how to solve the question. Just like your homework problems, it's important to understand the "why" behind the answer, even if you answer the question correctly.

Accounting Practice Quizzes

Below are five practice quizzes. These quizzes are a great way to practice accounting. Answering these questions efficiently will prepare you for your tests and quizzes. Click the orange text below the quiz to view the answers. Watch the video below each practice quiz to see further explanation on how to solve these accounting practice questions.

Additionally, if this information is helpful, you might consider signing up for my monthly subscription. My monthly subscription has more training videos like the ones below, a message board where you can ask me your specific questions, and discounts on one-on-one tutoring with me.

Practice Accounting Quiz 1: The Accounting Equation

-

- At year end, Smith Co.’s Assets totaled $46,000 and their Liabilities totaled $6,000. What is the amount of their Owner's Equity?

a) $52,000

b) $20,000

c) $40,000

d) $42,000 - During the year Jan Co.’s total Assets increased by $54,000 and total Liabilities increased by $21,000. How much did Owner's Equity change?

a) A $75,000 increase

b) A $33,000 increase

c) A $75,000 decrease

d) A $33,000 decrease - When supplies are purchased on account:

a) Assets decrease and Liabilities decrease

b) Assets increase and Liabilities decrease

c) Assets increase and Liabilities increase

d) Assets decrease and Liabilities increase - If an owner of a company withdraws money for personal use:

a) Assets decrease and Owner’s Equity decreases

b) Assets increase and Owner’s Equity decrease

c) Assets increase and Owner’s Equity increase

d) Assets decrease and Owner’s Equity increase - When supplies are purchased for cash:

a) Assets decrease and Liabilities increase

b) Assets increase and Liabilities increase

c) Total Assets remain the same and Liabilities decrease

d) Total Assets remain the same - When the current months utility bill is paid:

a) Assets decrease and Owner’s Equity increases

b) Assets decrease and Liabilities increase

c) Assets decrease and Owner’s Equity decreases

d) Assets decrease and Liabilities decrease - The following are examples of Assets:

a) Cash, Equipment, and Accounts Payable

b) Cash, Supplies, and Equipment

c) Cash, Supplies, and Accounts Payable

d) Supplies, Equipment, and Accounts Payable - When an owner invests cash in their business:

a) Assets remain the same

b) Assets increase and Liabilities increase

c) Assets increase and Owner’s Equity increases

d) Assets decrease and Liabilities increase - Tech Co.’s Liabilities totaled $12,000 and their Owner's Equity totaled $32,000. What is the amount of their Assets?

a) $20,000

b) $34,000

c) $44,000

d) $19,000 - A company had $4,000 in Revenue and $3,000 in Expenses for a period. How will this impact the accounting equation?

a) A $4,000 increase in Owner’s Equity

b) A $3,000 increase in Owner’s Equity

c) A $7,000 increase in Owner’s Equity

d) A $1,000 increase in Owner’s Equity - An investment in a company made by the owner is referred to as:

a) Accounts Receivable

b) Capital

c) Drawing

d) Cash - Angela Co. received payment from a customer on account. Angela Co. should:

a) Decrease Cash

b) Decrease Accounts Payable

c) Increase Accounts Payable

d) Decrease Accounts Receivable - A Balance Sheet shows:

a) Assets and Expenses

b) Revenue and Expenses

c) Assets and Revenues

d) Assets and Liabilities - Slim Co. has the following account balances: Cash $25,000, Accounts Receivable $24,600, Accounts Payable $2,000, and Supplies $3,000. Based on the given information, what is the amount of their Assets & Owner’s Equity?

a) $54,600 & $50,600

b) $52,600 & $52,600

c) $54,600 & $52,600

d) $52,600 & $50,600 - On November 1, 2019, Jan Co.’s Balance Sheet showed Assets of $65,000, Liabilities of $30,000, and Owner’s Equity of $35,000. Jan Co. had the following activity during November: an increase in Assets of $24,000, a decrease in Liabilities of $7,500, an owner’s cash withdrawal from the company in the amount of $10,000, and Revenues of $50,000. What were Jan Co.’s Expenses for November?

a) $13,500

b) $8,500

c) $66,500

d) Not enough information given

- At year end, Smith Co.’s Assets totaled $46,000 and their Liabilities totaled $6,000. What is the amount of their Owner's Equity?

Answers to Accounting Equation Quiz:

Q1

C

Q2

B

Q3

C

Q4

A

Q5

D

Q6

C

Q7

B

Q8

C

Q9

C

Q10

D

Q11

B

Q12

D

Q13

D

Q14

D

Q15

B

Watch the video below to see how I solve the questions on the Accounting Equation Quiz:

Practice Accounting Quiz 2: Debits & Credits

-

- The left side of an account

a) Increases the account balance

b) Decreases the account balance

c) Is the debit side of the account

d) Is the credit side of the account - Debiting an Asset account

a) Has no effect on the account balance

b) Decreases the account balance

c) Increases the account balance

d) None of the above - A credit is not the normal balance for which of the following accounts?

a) Jim Smith, Capital

b) Rent Expense

c) Notes Payable

d) Accounts Payable - For all transactions, the double-entry bookkeeping system requires that the

a) Total amount of debits must equal the total amount of credits

b) Total number of debits must equal the total number of credits

c) Total Assets must equal total Liabilities

d) Total Assets must be debited because a debit is the normal balance of an Asset - If the Accounts Payable account has debit amounts totaling $5,000 and credit amounts totaling $6,000, the Accounts Payable account balance is

a) A $6,000 debit balance

b) A $6,000 credit balance

c) A $1,000 debit balance

d) A $1,000 credit balance - Debits are used to

a) Increase Liabilities

b) Decrease Expenses

c) Increase Assets

d) Increase Owner’s Equity - Which of the following account types have credits as normal balances?

a) Liabilities and Revenues

b) Assets and Expenses

c) Liabilities and Expenses

d) Assets and Revenues - To record when a customer owes you money, you should:

a) Debit Accounts Payable

b) Credit Accounts Payable

c) Debit Accounts Receivable

d) Credit Accounts Receivable - An incomplete transaction has a debit to an Asset account for $12,000 and a credit to a Liability account for $15,000. To complete the transaction, you should:

a) Debit a Liability account for $25,000

b) Debit an Asset account for $25,000

c) Debit an Asset account for $3,000

d) Credit a Liability account for $3,000 - Normal balances are stated as follows:

a) Assets (DR), Liabilities (CR), Owner’s Equity (CR), Revenues (DR), & Expenses (CR)

b) Assets (DR), Liabilities (CR), Owner’s Equity (CR), Revenues (CR), & Expenses (DR)

c) Assets (CR), Liabilities (DR), Owner’s Equity (DR), Revenues (CR), & Expenses (DR)

d) Assets (CR), Liabilities (DR), Owner’s Equity (DR), Revenues (DR), & Expenses (CR) - Which of the following is not true?

a) Debit is the left side of the account and credit is the right side of the account

b) Debits increase an account balance and credits decrease an account balance

c) Debit is abbreviated as DR

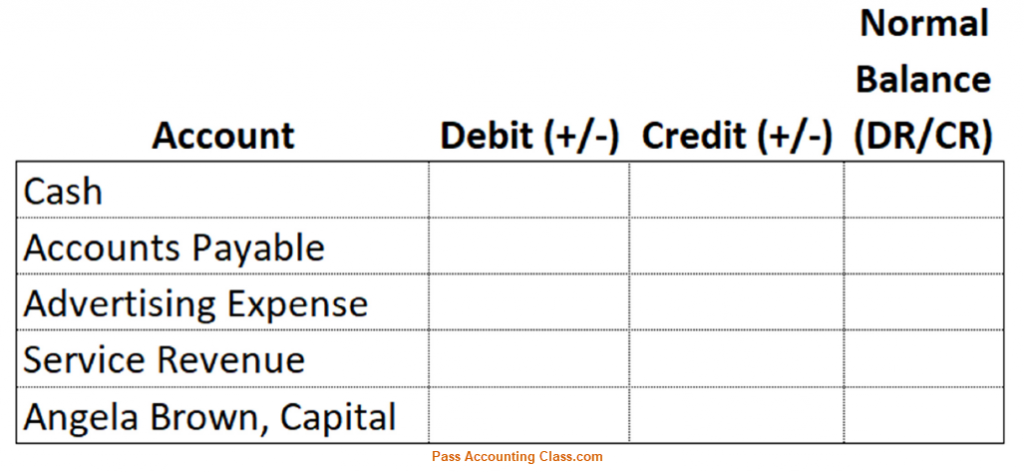

d) Credit is abbreviated as CR - Fill out the table below by indicating if the account balance increases or decreases with a debit, increases or decreases with a credit, and if the normal balance is a debit or credit.

- The left side of an account

Answers to Debits & Credits Quiz:

Q1

C

Q2

C

Q3

B

Q4

A

Q5

D

Q6

C

Q7

A

Q8

C

Q9

C

Q10

B

Q11

B

Q12

Cash + - DR

Accounts Payable - + CR

Advertising Expense + - DR

Service Revenue - + CR

Angela Brown, Capital - + CR

Watch the video below to see how I solve the questions on the Debits & Credits Quiz:

Practice Accounting Quiz 3: Journal Entries

-

- When Angela Smith, the owner of Smith Co., withdrawals cash for personal use, the journal entry should

a) Debit Angela Smith, Drawing and credit Angela Smith, Capital

b) Debit Angela Smith, Drawing and credit Cash

c) Debit Cash and credit Angela Smith, Drawing

d) Debit Cash and credit Angela Smith, Capital - A compound journal entry

a) Has only one credit and one debit

b) Has two debits

c) Has two credits

d) Affects more than one debit and/or more than on credit - To record services performed for cash, you would

a) Debit Service Revenue and credit Cash

b) Debit Service Revenue and credit Accounts Receivable

c) Debit Accounts Receivable and credit Cash

d) Debit Cash and credit Service Revenue - To journalize the purchase of equipment for $12,000 using a $3,000 cash down payment with the balance due in 15 days, you should

a) Debit Equipment $12,000 and credit Cash $12,000

b) Debit Equipment $12,000, credit Cash $3,000, and credit Accounts Payable $9,000

c) Debit Cash $12,000, credit Equipment $3,000, and credit Accounts Payable $9,000

d) Debit Accounts Payable $12,000, credit Cash $3,000, and credit Equipment $9,000 - When a business writes a check for the current months’ advertising, the journal entry should

a) Debit Cash and credit Advertising Expense

b) Debit Advertising Expense and credit Cash

c) Debit Advertising Expense and credit Accounts Payable

d) Debit Accounts Receivable and credit Advertising Expense - On June 30th, Jan Co. received a telephone bill for June’s phone services. This bill will be paid in July. What is the journal entry for the bill?

a) Debit Telephone Expense and credit Cash

b) Debit Cash and credit Telephone Expense

c) Debit Telephone Expense and credit Accounts Payable

d) Debit Accounts Payable and credit Telephone Expense - Recording a journal entry for receiving payment from a credit customer on account includes

a) Crediting Accounts Payable

b) Debiting Accounts Payable

c) Debiting Accounts Receivable

d) Crediting Accounts Receivable - List which accounts should be debited and which accounts should be credited. Use the accounts listed below.

Cash, Accounts Receivable, Equipment, Accounts Payable, Chad Brown, Capital, Chad Brown, Drawing, Service Revenue, Advertising Expense, Rent Expense, & Utilities Expense

a) Chad Brown contributed capital to his business.

b) A credit customer paid on their account.

c) Performed services for cash.

d) Purchased equipment for cash.

e) Issued a check to Chad Brown for personal use. - Based on the transactions below, list which accounts should be debited and which accounts should be credited.

a) Performed services for $2,000 cash

b) Issued a check for $500 for new equipment

c) Paid the monthly rent by issuing a check for $1,000

d) Rendered services for $1,500 on credit

e) Collected $500 from a credit customer

f) Wrote a $120 check for the monthly utility bill

g) Paid a creditor by issuing a $600 check

h) Purchased $2,000 worth of supplies on credit

- When Angela Smith, the owner of Smith Co., withdrawals cash for personal use, the journal entry should

Answers to Journal Entries Quiz:

Q1

B

Q2

D

Q3

D

Q4

B

Q5

B

Q6

C

Q7

D

Q8

A. Cash (DR), Chad Brown, Capital (CR)

B. Cash (DR), Accounts Receivable (CR)

C. Cash (DR), Service Revenue (CR)

D. Equipment (DR), Cash (CR)

E. Chad Brown, Drawing (DR), Cash (CR)

Q9

A. Cash $2,000 (DR), Service Rev. $2,000 (CR)

B. Equipment $500 (DR), Cash $500 (CR)

C. Rent Exp. $1,000 (DR), Cash $1,000 (CR)

D. AR $1,500 (DR), Service Rev. $1,500 (CR)

E. Cash $500 (DR), AR $500(CR)

F. Utility Exp. $120 (DR), Cash $120 (CR)

G. AP $600 (DR), Cash $600 (CR)

H. Supplies $2,000 (DR), AP $2,000 (CR)

Watch the video below to see how I solve the questions on the Journal Entries Quiz:

Practice Accounting Quiz 4: T-Accounts

- On June 1st, the Cash account had a normal balance of $22,000. During June there were the following entries: a $4,000 credit, a $6,000 debit, a $5,000 credit, and a $2,000 debit. What is the account balance on June 30th?

a) $23,000 debit balance

b) $21,000 debit balance

c) $23,000 credit balance

d) $21,000 credit balance - Kraft Co.’s Owner’s Equity was $30,000 on June 1st. During June, Kraft Co. reported $5,000 in revenue, $2,000 in expenses, and an Owner’s draw of $1,000. What is Kraft Co’s Owner’s Equity on June 30th?

a) $32,000 credit balance

b) $32,000 debit balance

c) $28,000 credit balance

d) $28,000 debit balance - On December 1st, Angela Co.’s Accounts Payable account had a balance of $31,000. During December they had purchases on account totaling $21,000, collected from credit customers on account totaling $4,000, and made payments on account totaling $9,000. What is the Accounts Payable balance on December 31st?

a) $43,000 credit balance

b) $39,000 credit balance

c) $43,000 debit balance

d) $39,000 debit balance - On April 1st, Jones Co.’s Accounts Receivable account had a balance of $23,000. During April they had sales on account totaling $14,000 and collected from credit customers on account totaling $8,000. What is the account balance on April 30th?

a) $17,000 credit balance

b) $17,000 debit balance

c) $29,000 credit balance

d) $29,000 debit balance - On March 1st, Smith Co.’s supplies account totaled $3,000. During March, Smith Co. used $2,000 of supplies and purchased $4,000 in supplies. What is the supplies account balance on March 31st?

a) $5,000 credit balance

b) $5,000 debit balance

c) $1,000 credit balance

d) $1,000 debit balance - On January 1st, Jones Co. had the following account balances:

Cash 12,000; Accounts Receivable 15,000; Supplies 2,000; Prepaid Rent 0; Accounts Payable 7,000; Adam Jones, Capital 22,000; Adam Jones, Drawings 0; Sales 0; Advertising Expense 0; Rent Expense 0.

During January, Jones Co. had the following transactions:

a) Paid $2,500 cash for supplies.

b) Received $4,000 from credit customer on their account.

c) Made sales of $6,000 on account.

d) Issued a check in the amount of $500 for the current months’ advertising.

e) Issued a check in the amount of $4,500 for the next 3 months rent.

What is the balance on January 31st for the following accounts?

-Cash

-Accounts Receivable

-Prepaid Rent - Create T-Accounts for the following transactions and total the account balances. All accounts start with zero balances. Use the following accounts:

Cash, Accounts Receivable, Equipment, Supplies, Accounts Payable, Service Revenue, Rent Expense, & Utilities Expense

a) Performed services for $20,000 cash

b) Issued a check for $500 for new equipment

c) Paid the monthly rent by issuing a check for $1,000

d) Rendered services for $1,500 on credit

e) Collected $500 from a credit customer

f) Wrote a $120 check for the monthly utility bill

g) Purchased $2,000 worth of supplies on credit

h) Paid a creditor by issuing a $600 check

Answers to T-Account Quiz:

Q1

B

Q2

A

Q3

A

Q4

D

Q5

B

Q6

Cash 8,500 (DR)

Accounts Receivable 17,000 (DR)

Prepaid Rent 4,500 (DR)

Q7

Cash 18,280 (DR)

Accounts Receivable 1,000 (DR)

Equipment 500 (DR)

Supplies 2,000 (DR)

Accounts Payable 1,400 (CR)

Service Revenue 21,500 (CR)

Rent Expense 1,000 (DR)

Utilities Expense 120 (DR)

Watch the video below to see how I solve the questions on the T-Account Quiz:

Practice Accounting Quiz 5: The Trial Balance

-

- Which of the following errors would you discover in the Trial Balance?

a) A journal entry that’s not been posted

b) A transaction that’s not been journalized

c) Incorrect accounts used when journalizing a transaction

d) An error transferring a debit balance to the credit column - The following would cause the Trial Balance to be out of balance:

a) Putting the Cash balance in the debit column

b) Putting the Equipment balance in the debit column

c) Putting the Accounts Receivable balance in the credit column

d) Putting the Notes Payable balance in the credit column - How would posting a journal entry to the wrong accounts impact the Trial Balance?

a) It wouldn’t impact the Trial Balance

b) Total credits would be understated and total debits would be understated

c) Total credits and total debits would be properly stated and individual account balances would be correct

d) Total credits and total debits would be properly stated, but individual account balances would be incorrect - Find the error(s) in the following Trial Balance. All accounts have normal balances.

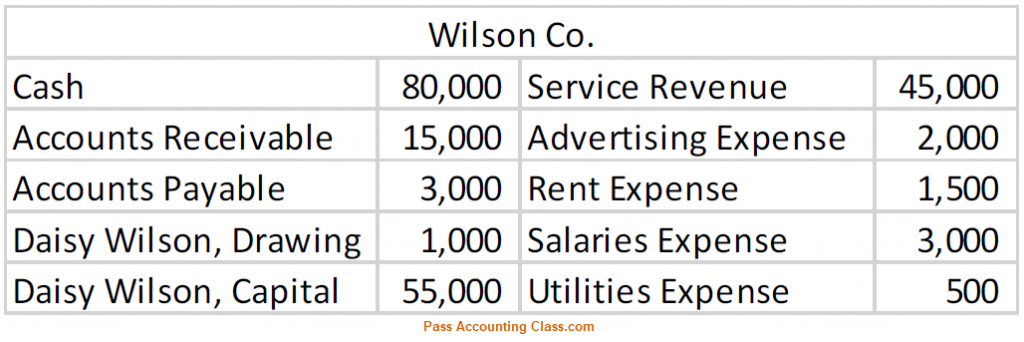

- Wilson Co. had the following account balances for the end of the month. All accounts have normal balances.

Credits on the Trial Balance should total:

Credits on the Trial Balance should total:

a) $102,000

b) $103,000

c) $107,000

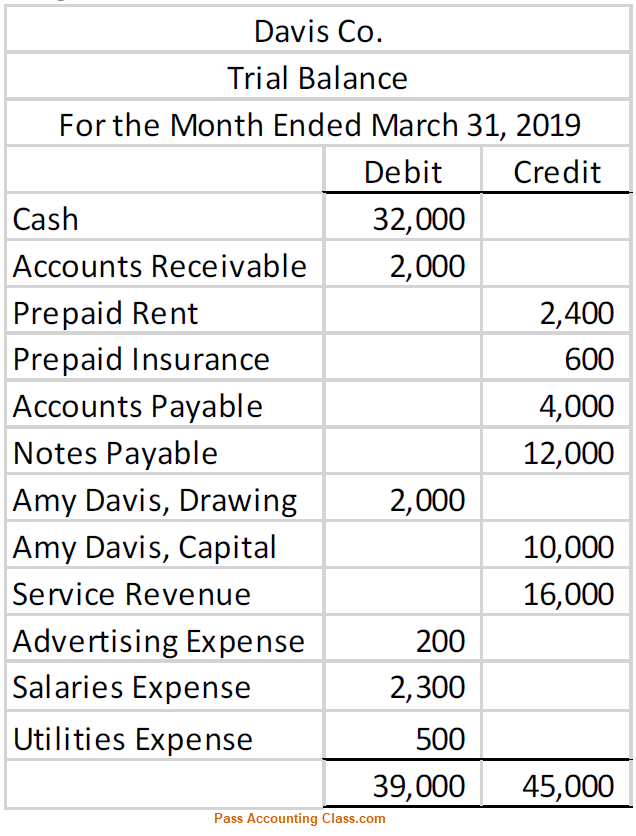

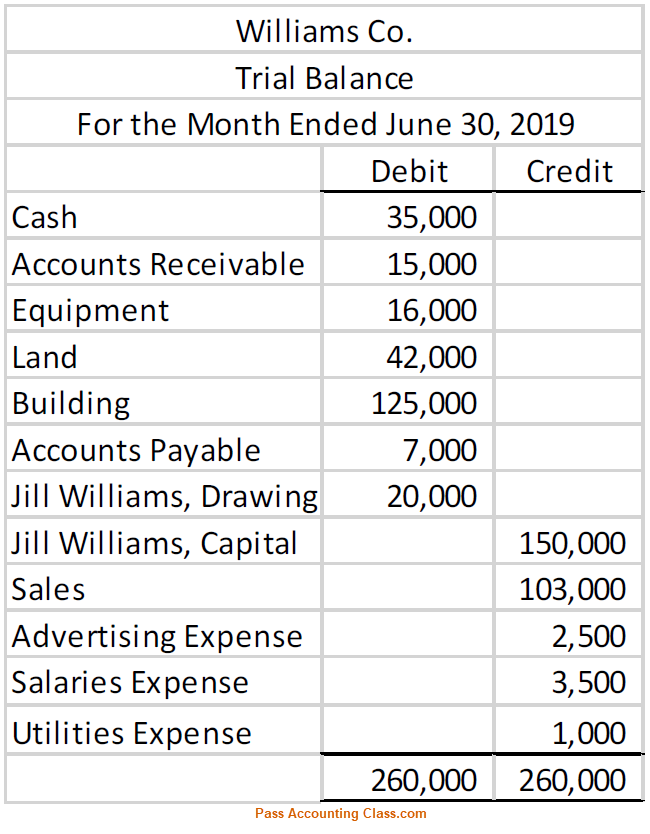

d) $140,000 - You’ve been asked to review the following Trial Balance to make sure it was prepared properly. Identify the errors (if any). All accounts have normal balances.

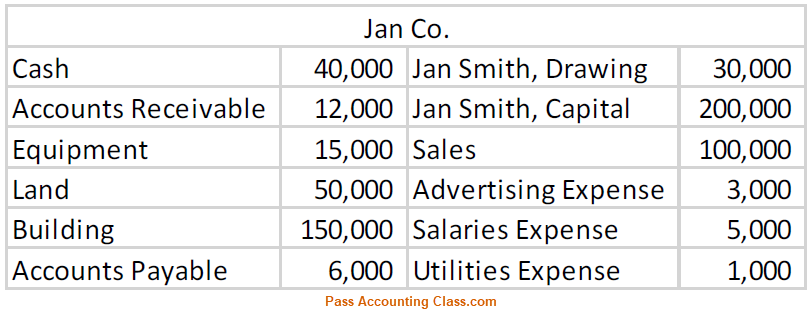

- Create a Trial Balance for Jan Co. for the month ended February 28, 2019 using the accounts and balances below. All accounts have normal balances.

- Which of the following errors would you discover in the Trial Balance?

Answers to Trial Balance Quiz:

Q1

D

Q2

C

Q3

D

Q4

Prepaid Rent and Prepaid Insurance should be Debited, not Credited.

Q5

B

Q6

Accounts Payable should be Credited, not Debited.

Advertising, Salaries, & Utilities Expenses should be Debited, not Credited.

Q7

Total Debits = 306,000

Total Credits = 306,000

Watch the video below to see how I solve the questions on the Trial Balance Quiz:

As I'm sure you know, there is a lot of information to learn for your accounting class. My my goal is to help you pass your accounting class, so if you need help, reach out to me! I have more practice tests and practice quizzes like the ones above. The best way to learn accounting is to practice accounting! I can get you up to speed and back on track quickly. I'm available for one-on-one tutoring here , have a bunch of video training here (scroll to the bottom to see all the lesson topics), or check out some of my free videos on YouTube here.