What is “accounting principles?”

Definition

Accounting principles are generally accepted standards that are universally practiced. Collectively, they are commonly referred to as Generally Accepted Accounting Principles (GAAP), although many people who don’t know what the term actually stands for mistakenly use “GAPPS” instead. A more practical definition of GAAP is a set of rules, standards, or common practices that provide guidance for the accounting profession. They provide guidance for all aspects of accounting from basic accounting concepts to highly complex accounting transactions. When properly applied, GAAP lay a foundation that allows for consistent results in accounting treatment and financial statement preparation. Keep reading to see some accounting principles explained below.

What is GAAP?

a. Accounting principles that tell businesses how to record financial transactions or economic events and where those transactions should appear on financial statements.

b. Accounting guidelines are created by the Financial Accounting Standards Board (FASB). FASB is the primary accounting standard-setting body in the United States.

c. GAAP are designed to create consistency in financial statement reporting. This is helpful within a company, comparing from one time period to another time period. Additionally, it’s essential to have consistent standards when comparing one company’s financial statements to another company’s financial statements. This “uniformity” in financial statement preparation is crucial for the accounting profession. In fact, the United States’ Securities and Exchange Commission (SEC) requires publicly traded companies to follow GAAP.

d. GAAP are influenced by basic, time-tested accounting principles and assumptions. Additionally, these accounting guidelines are used as a basis to help create a common, universally-accepted set of accounting standards that guide the Accounting profession/industry.

e. Where to find GAAP standards: GAAP standards can be found on the FASB’s website: https://asc.fasb.org/home . They offer a “Basic View” option, which is free. This allows you to search the code without creating an account. I’ve not seen a first year accounting class that requires searching the code, but it’s good to know where to find it.

Why are these principles so important?

Generally Accepted Accounting Principles (GAAP) are important because they provide guidance and standards for accounting professionals. Without this guidance, accountants wouldn’t know how to properly interpret financial transactions. The standards assist in determining the treatment of financial transactions and this creates consistency within the accounting profession. Additionally, GAAP principles provide guidance on financial statement presentation. Financial statements would be nearly impossible to compare without this guidance.

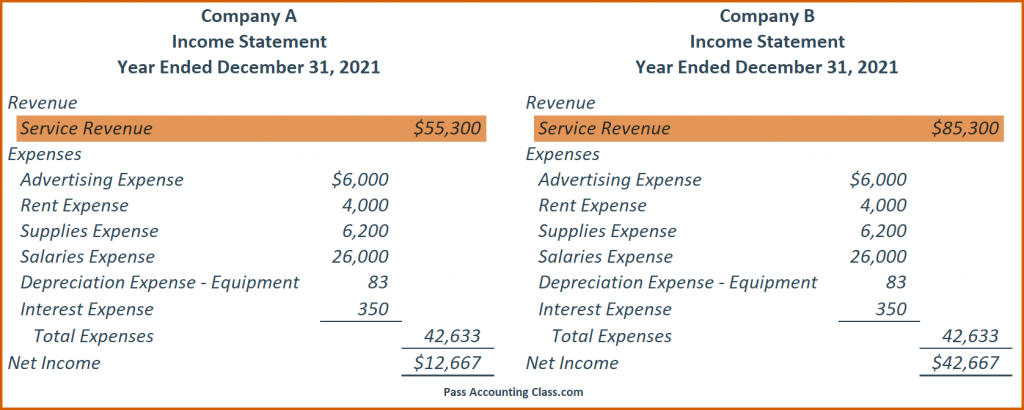

The best way to understand GAAP is to see some examples of these accounting principles in action. For example, let’s say there are two identical companies, Company A and Company B, with identical financial transactions. Company A uses GAAP and Company B doesn’t. Each company received a $30,000 payment for future services to be performed next year. Company A records it as Unearned Revenue, a Liability account, in accordance with GAAP. Company B records it as Service Revenue for the current year. Below are the Income Statements for Company A and Company B after receipt of the $30,000.

The Income Statements above show the impact of treating one transaction differently. It resulted in Company B showing an additional $30,000 in Revenue and Net Income. That’s a big deal! Now imagine if more transactions were treated differently.

Accounting principles are important because they allow lenders, investors, and others to compare the financial health of two companies so they can make informed decisions. Investors and lenders want information reported in a consistent manner.

Here’s another example. Let’s say you had money to invest. Based on the Income Statements above, would you invest in Company A or Company B? I would invest in Company B because it appears that Company B earned more Revenue during the year and had a higher Net Income. I’m comparing Company B’s Revenue of $85,300 to Company A’s Revenue of $55,300 and Company B’s Net Income of $42,667 to Company A’s Net Income of $12,667. Company B looks more promising to me, and if all things are equal, I expect Company B to continue out-earning Company A.

Here’s the problem, as stated earlier, Company A and Company B didn’t use the same accounting treatment for the $30,000. The $30,000 isn’t on Company A’s Income Statement, it’s on Company A’s Balance Sheet in the Liability section. So, we really can’t compare these two Income Statements; it’d be like comparing apples to oranges.

Accounting principles also are important because accountants need a standard to depend on while creating financial statements. They do this to produce consistent financial statements. A lot of accountants prefer GAAP as a guide, so they don’t have to use their own judgement. Accounting already involves a decent amount of judgment calls which can lead to inconsistencies. Without GAAP, accountants would have to make more judgment calls, and this could result in even more inconsistencies.

Additionally, there are many people that rely on accountants and their judgement calls. In some instances, they may look to influence the accountant’s judgement. Accountants work with financial figures (money) and where there’s money, there’s potential for fraud. Without GAAP, financial transaction treatment could easily be manipulated to achieve desired results, regardless of accuracy.

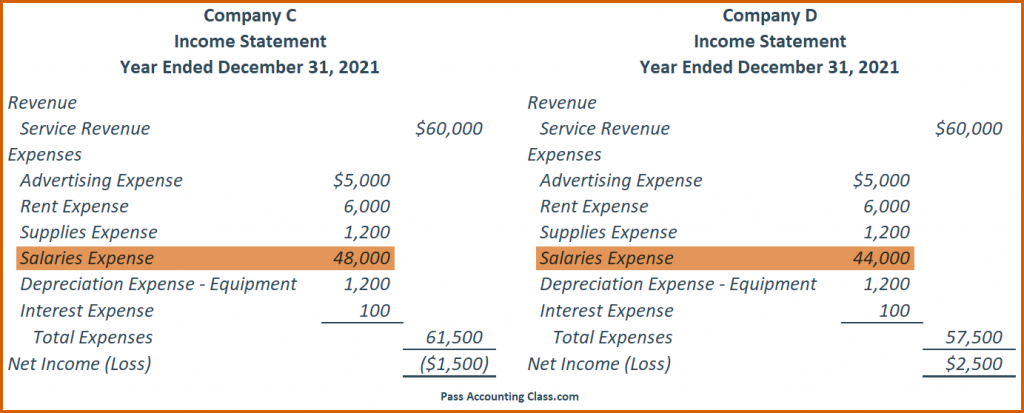

For example, Company C and Company D started business on January 1, 2021. They each have identical financial transactions. Salaries Expense per month totals $4,000 and the current month’s salaries are to be paid in the next month. See the Income Statements for Company C and Company D below.

Company C uses GAAP and recorded a $4,000 Salaries Expense for December even though they are going to pay December’s Salaries in January 2022. Salaries Expense totals $48,000 for the year ($4,000 per month multiplied by 12 months). This results in a Net Loss of $1,500 for 2021. This means that Company C didn’t earn money from their operations in 2021, instead they lost $1,500. Despite the loss, Company C is properly accounting for Salaries Expense under GAAP.

In contrast, Company D uses GAAP most of the time, but management is pressuring the accountant to show Net Income for 2021, not a Net Loss. So, they get creative with their accounting and only record the amount they actually spent on Salaries in 2021. This does not conform to GAAP accounting. This amounts to 11 months of Salaries Expense paid. Salaries Expense totals $44,000 for the year ($4,000 per month multiplied by 11 months). This results in Net Income of $2,500 for 2021. In theory, this means Company D earned money from their operations in 2021. But we know the only reason Company D looks profitable is because their accountant made a poor judgement call.

Regardless of the outcome and financial results, it’s best to adhere to GAAP. As you can see Company C used GAAP and reported a Net Loss. A Net Loss is not favorable to the company, but it’s correct to report a Net Loss. Company D altered the Salaries Expense amount to present themselves more favorably. This is misleading and could be considered fraudulent.

Similar to our previous example with Company A and Company B, which company would you invest in, Company C or Company D? Knowing what you know now, I hope you’d choose Company C.

As you can see from the examples, users of financial statements depend on the accuracy of the financial statements and the accuracy comes from consistent application of GAAP. Consistent application of GAAP gives users of financial statements and the accountants that prepare them confidence in the end result. Accounting principles allow users of financial statements to understand the financial health of a company.

How many accounting principles are there?

It’s common to see between 5 to 15 principles in your first accounting class. Some principles have multiple names, and some are referred to as assumptions. Regardless, you’ll want to stick with what your teacher and/or textbook require you to learn as this will be what you’re tested on.

Some classes don’t focus too much on the principles themselves, but the concepts associated with the principles are prevalent throughout the class. I’ve worked with some students that don’t even realize they’ve learned the principles because the principles are simply standard ways of “doing accounting.”

For example, if you’re taught to record revenue as soon as a product is sold or when the service is performed, you’re applying the Revenue Recognition Principle. The textbook or teacher may not explain that this is a “principle,” but it is. Oftentimes I work with students that don’t know the name of the principles, but they understand the concepts associated with the principles. For whatever reason, this is a common trend in first year accounting classes. Regardless, it’s a good idea to learn the name of the principle as well as the concepts associated with the principle.

Where is GAAP used?

We use GAAP in the United States. Somet call it US GAAP. Public companies, companies traded on the stock market, must use GAAP. This requirement comes from the Securities and Exchange Commission (SEC) as they regulate publicly traded companies in the US. As illustrated earlier, requiring publicly traded companies to use GAAP helps investors understand the financial health of a company. Additionally, it allows investors to make an appropriate comparison from one publicly traded company to another.

International Financial Accounting Standards (IFRS) are accounting principles used outside the United States. The International Accounting Standards Board (IASB) issues IFRS. IFRS look to accomplish a similar goal to GAAP, they just approach it differently. IFRS replaced older standards, called International Accounting Standards (IAS), in 2001. Most first year accounting classes in the US mention IFRS but usually don’t require students to learn IFRS.

Are GAAP regulations enforced by the IRS?

The IRS does not enforce GAAP regulations. The IRS is primarily concerned with properly determining the amount of income tax owed, timely filing, and timely submitting amounts owed. Lending institutions often require GAAP accounting when a company requests a loan. As mentioned earlier, the SEC, a regulating body, also requires GAAP accounting. Despite the fact that GAAP can be complex and time-consuming to implement and maintain, the principles provide a consistent standard for financial statement users.

7 Basic Accounting Principles Every Accounting Student Must Know

Below are seven accounting principles that you’ll probably see in your first accounting class. As mentioned earlier, some schools don’t teach the principles by name, instead you may be taught the concepts associated with the principle. For example, the Matching Principle is the first principle in the list below. Your textbook or teacher may simply refer to this as accrual basis accounting and teach you what it means to do accrual basis accounting.

Matching Principle – This principle states that you should record a related expense when you record a revenue. This is the foundation of accrual basis accounting.

Revenue Recognition Principle – This principle states that you should record revenue only when it’s been earned, regardless of payment received or not received.

Conservatism Principle – This principle states that when there’s an option in reporting a transaction, you should use the option that results in lower asset amounts and/or lower net income.

Monetary Unit Assumption – This assumption states that a business should only record economic events that can be expressed in a unit of currency.

Economic Entity Assumption – This assumption states that a business is separate entity from the owners.

Going Concern Principle – This principle assumes that a business will remain in operation for the foreseeable future.

Cost Principle – This principle states that you should record purchases at the original amount spent to acquire the item.

Check out this post for more detail on these 7 Basic Accounting Principles.

Learning and understanding accounting principles can seem like a daunting task, but I’m here to help you succeed. I’m here to help you pass accounting class! There’s no need to feel stressed out because there’s never enough time to finish all the questions on your accounting quizzes and tests. My students efficiently solve accounting problems with confidence in the allotted time. I want to show you how to do this with my Pass Accounting Class program.

My Pass Accounting Class membership program is monthly (month to month), features video training lessons with learning materials, has a private message board where you can ask me your questions, and offers discounted rates for one-on-one tutoring sessions with me. Use the membership as long as you need and cancel anytime. Use the coupon code ” halfoff ” to get your first month half off! Click the button below to enroll!