Ready to master the basic accounting equation in 10 minutes or less?

Whether you’re new to accounting or brushing up on accounting basics, you’ve come to the right place. The accounting equation is a fundamental concept that will be used throughout your accounting courses and the cornerstone of understanding financial statements and accounting principles. Today, we’re diving into a quick, comprehensive guide that’ll have you mastering it in no time. Grab your notepad, and let’s get started!

What is the Basic Accounting Equation?

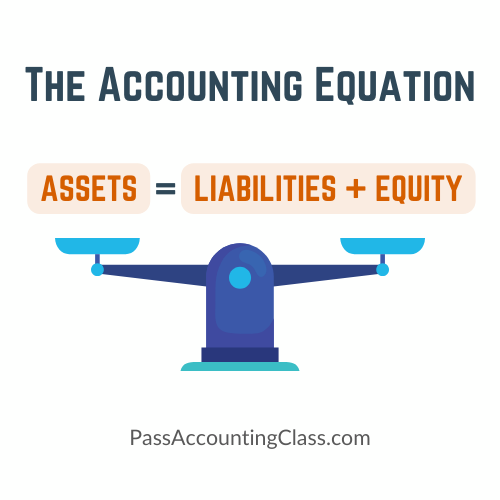

The basic accounting equation (also known as the Balance Sheet Equation) is a mathematical formula that forms the foundation of double-entry accounting. It’s a simple yet powerful concept that states: Assets = Liabilities + Equity.

In other words, a company’s resources (assets) are funded by debts (liabilities) or owner investment (equity) in the business. And it is essential to keep the equation in balance for every financial transaction.

Mastering the Basic Accounting Equation in 5 Steps

Step 1: Understanding the Terms

The basic accounting equation is comprised of three key components:

- Assets: Resources owned by a company, like cash, inventory, and property.

- Liabilities: What the company owes, such as loans or accounts payable.

- Equity: The owner’s residual interest in the company, calculated as Assets minus Liabilities. The initial investment of a business owner is also classified as equity.

You can gain a deeper understanding of these accounting concepts and which business transactions comprise each of these account types with our Accounting Essentials Resources.

Step 2: The Equation in Action

1. Visualize: Think of a scale in balance. On one side are your assets, and on the other, liabilities and equity together, always equaling each other so the equation stays balanced.

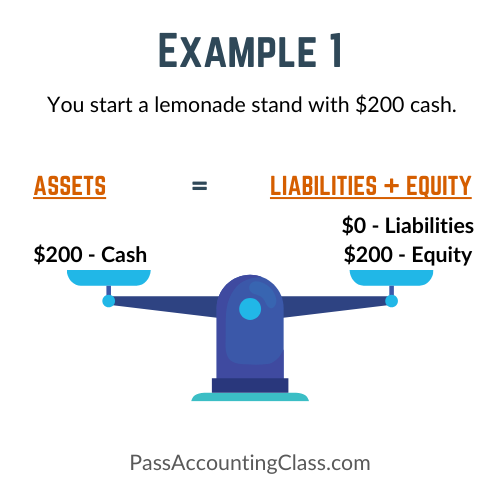

2. Real-Life Application: Imagine you start a lemonade stand with $200 cash (Asset). You invested this amount, so Equity is also $200. And you have no debts (Liabilities). Your current Assets now equal your current Liabilities plus Equity, fulfilling the equation.

Step 3: Transactions and Their Impact

Every transaction affects the equation. Let’s see how in these accounting equation examples:

Buying Inventory on Credit: Inventory is an asset, and buying assets on credit affects liabilities as well as assets. It increases your assets (inventory) and liabilities (accounts payable).

An example of how to record this type of accounting transaction using the double-entry system: Your lemonade stand needs lemons, sugar, cups, and ice that cost $75, so you purchase them on your credit card. Your assets are now $275 – the $200 you originally invested plus the $75 in inventory and supplies. Your Equity is still $200. And you now have $75 in credit card debt (Liabilities). So your Equity + Liabilities are also $275, and the accounting equation balances.

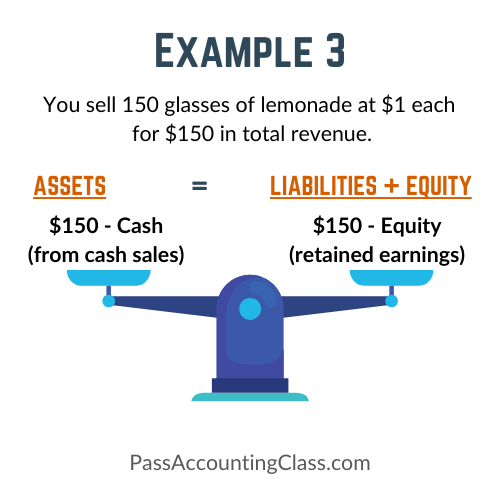

Earning Revenue: There is a direct relationship between assets and owner equity when it comes to revenue. Earned revenue increases your assets (cash or accounts receivable) and equity (retained earnings).

Here’s another example using the double-entry system. You sell 150 glasses of lemonade at $1 each, which gives you $150 in cash (Asset) from lemonade sales. And you decide to hang onto that $150 to reinvest in the business later down the road, so that becomes $150 in retained earnings and your Equity increases.

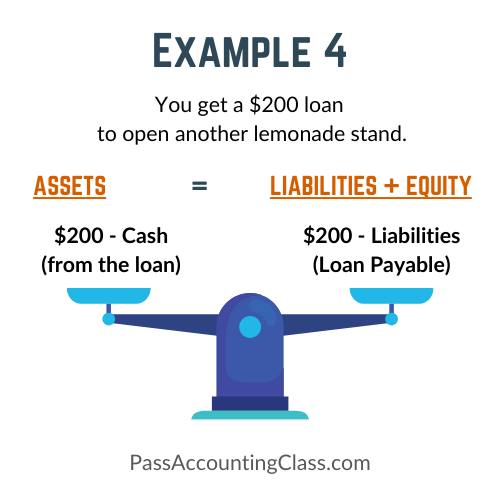

Taking a Loan: A business loan allows a business to pay for expansion and growth without dipping into its cash reserves. As a result, a bank loan increases your assets (cash) and liabilities (loan payable).

Here’s an example of asset purchases using double-entry bookkeeping. Your lemonade stand is doing so well that you decide to get a $200 loan to open another lemonade stand. This increases your assets by $200 (the value of the new lemonade stand) and your liabilities by $200 for the value of the loan.

These are just a few examples of how we maintain the balance of assets to liabilities and owner equity.

Step 4: Practice Makes Perfect

The best way to grasp the basic accounting equation is through practice. Try adjusting different transactions and see how they affect each component. Use simple scenarios like purchasing equipment, paying off loans, or investing more cash into the business. We provide step-by-step Accounting Equation homework solutions and practice tests in our Pass Accounting Class Resources.

Step 5: Quick Quiz

Test your understanding of the fundamental accounting equation and double-entry bookkeeping system with a quick quiz. Given a company with $10,000 in assets and $6,000 in liabilities, what’s the equity? Use the accounting equation formula: Assets = Liabilities + Equity to solve this.

Additional Tips

- Flashcards: Create flashcards for terms and transactions to drill the concepts.

- Real-world Applications: Apply the equation to real or hypothetical businesses.

- Online Resources: Utilize online tutorials and quizzes like those available on Pass Accounting Class Resources to help you master the accounting equation.

Conclusion

Congratulations! You’ve taken a significant step towards mastering a fundamental formula that will be used repeatedly throughout your accounting courses. Remember, the basic accounting equation is foundational to understanding the financial position of a business. Keep practicing, and soon, this equation will become second nature.

Stay curious, and happy learning!