Welcome to the world of accounting, a vital discipline that forms the backbone of every successful business. Whether you’re a student just starting your journey into finance or someone curious about the basics of accounting, this blog is designed to demystify the core concepts you should know. Let’s dive into the fundamental principles that make accounting an indispensable tool in the business world.

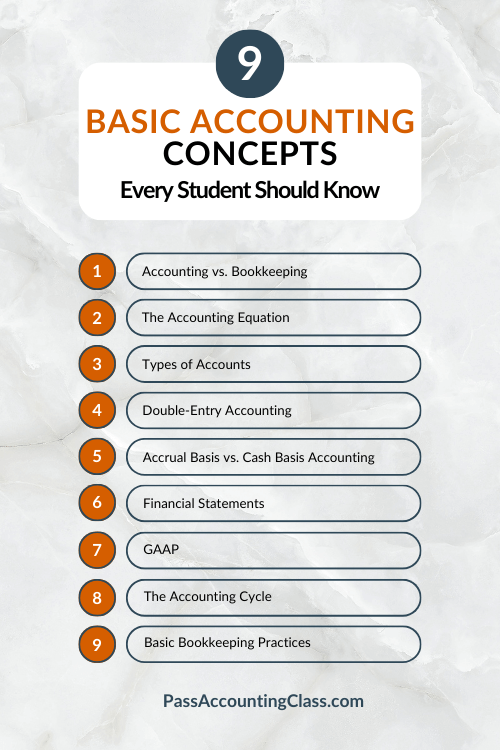

9 Basic Accounting Concepts Every Student Must Know to Pass Accounting Class

1. Understanding Accounting

At its core, accounting is the process of recording, summarizing, analyzing, and reporting financial transactions of a business. It’s an essential practice that provides stakeholders with critical information about a company’s financial health. Unlike bookkeeping, which focuses on recording transactions – managing accounts receivable, accounts payable, and journal entries – accounting involves a broader scope of financial analysis, reporting, and strategic planning.

2. The Accounting Equation

The cornerstone of accounting is the accounting equation: Assets = Liabilities + Equity. This equation lays the foundation for the balance sheet, one of the key financial statements. It represents the relationship between a company’s resources (assets), its debts (liabilities), and the owners’ share in the business (owners’ equity).

In double-entry accounting, each transaction impacts at least two accounts: a debit is applied to one account while a credit is applied to another. For example, when a business borrows money from a bank, its cash account (an asset) increases with a debit, while its liability account (for the loan) increases with a credit. This maintains the balance of the accounting equation.

Understanding how assets, liabilities, and owners’ equity interact is essential. Assets represent what the business owns, liabilities represent what the company owes, and owner’s equity represents the owner’s stake in the company. When a business acquires more assets through profits (increasing owner’s equity) or loans (increasing liabilities), the balance sheet remains balanced due to the accounting equation. Overall, the accounting equation is a fundamental tool to ensure the accuracy and integrity of financial statements.

3. Types of Accounts

Understanding the five main types of accounts is crucial:

- Assets: Resources owned by the company (e.g., cash, inventory) that have future economic value.

- Liabilities: Obligations or debts owed to outsiders (e.g., loans, accounts payable).

- Equity: The owner’s claims to the assets after liabilities are settled.

- Revenues: Income earned from the company’s operations.

- Expenses: Costs incurred in earning revenue.

Each type of account serves a specific purpose within the financial system. Assets and liabilities show a company’s financial status, while equity represents the owner’s investment. Revenues and expenses track the income and costs related to the company’s operations.

A chart of accounts is a comprehensive list of all a company’s accounts. It organizes the main categories and subcategories of accounts and is essential for organizing financial transactions and maintaining an accurate general ledger.

These accounts interact within the accounting equation, providing a comprehensive view of a company’s financial standing. By understanding the different types of accounts and their specific functions, a company can accurately track its financial transactions and overall financial status.

4. Double-Entry Accounting

Double-entry accounting is a fundamental principle where every transaction affects at least two accounts, represented through debits and credits. This means that for every debit entry made to one account, there must be a corresponding credit entry to another account. The process involves recording all transactions in a journal and then transferring them to respective accounts in the general ledger.

The double-entry system ensures the accounting equation remains balanced and enhances the accuracy of financial records.

This means that the total debits must equal the total credits, providing a reliable way to verify the accuracy of financial records.

Employing double-entry accounting offers several benefits for small and growing businesses. It provides a comprehensive and systematic way to track financial transactions, enabling better decision-making and financial analysis. It also helps identify any errors or inconsistencies in the accounts, making detecting and rectifying mistakes easier. Additionally, it provides a clear audit trail, making it easier to demonstrate financial accuracy and compliance to stakeholders.

5. Accrual Basis vs. Cash Basis Accounting

There are two primary methods of recording accounting transactions: (1) accrual basis and (2) cash basis. Here’s a brief overview of the differences between these two methods of accounting.

- Accrual basis accounting records transactions when they occur, regardless of when cash is exchanged.

- Cash basis accounting records transactions only when cash is exchanged.

This affects financial reporting, as the accrual method more accurately reflects a company’s financial position over time, while the cash method reflects only the immediate cash flow.

The advantage of accrual-based accounting is its accuracy in matching income and expenses, providing a more comprehensive view of a company’s financial health. However, it requires careful tracking of accounts receivable and accounts payable. Cash basis accounting, on the other hand, is simpler and provides a clearer view of cash flow, making it easier for small businesses to manage their finances. However, it may not accurately represent long-term financial performance.

For example, under accrual-basis accounting, revenue is recorded when it’s earned, even if cash has yet to be received. Conversely, cash-basis accounting records revenue only when cash is received. These differences impact financial reporting and can have tax implications for businesses. Understanding the pros and cons of each method is crucial for accurate financial management and reporting.

6. Financial Statements

The four major financial statements include:

- Balance Sheet: Shows a company’s assets, liabilities, and equity at a specific point in time to give a clear picture of its financial health.

- Income Statement (a.k.a. Profit & Loss Statement): Reports on a company’s financial performance over a specific time period, detailing revenues and expenses.

- Cash Flow Statement: Tracks the flow of cash in and out of the business, providing insights into its liquidity and solvency.

- Statement of Changes in Equity: Reflects changes in the owners’ equity account over a period of time, including any dividends paid or shares issued.

Although these documents are interconnected, each financial statement serves a unique purpose in providing a comprehensive view of a business’s financial health. Together, they offer a holistic view of the business’s financial position, performance, and the changes in its financial status over time.

7. The Importance of GAAP and IFRS

Generally Accepted Accounting Principles (GAAP) and International Financial Reporting Standards (IFRS) are two sets of accounting standards that guide the preparation of financial statements. GAAP is used primarily in the United States, while IFRS has global acceptance. Adhering to these standards ensures consistency, transparency, and comparability of financial reports.

GAAP and IFRS differ in key accounting principles, such as the treatment of inventory, revaluation of assets, and the use of the last-in, first-out (LIFO) method. These differences can impact international business transactions by affecting how financial information is reported and interpreted.

In the U.S., companies use GAAP to ensure financial statements are consistent and comparable. Publicly traded companies must follow GAAP to provide transparency and accountability to investors and stakeholders. In contrast, many companies use IFRS internationally to facilitate comparability across borders.

Comparing financial statements from companies in different countries can be challenging due to differing accounting principles. This can lead to discrepancies in financial reporting, making it harder for investors and analysts to evaluate and compare the performance of these companies. Therefore, understanding and addressing these challenges is crucial for accurate financial analysis and decision-making in the global business environment.

8. Accounting Cycle

The accounting cycle is a series of steps for recording, analyzing, and reporting financial information. It begins with collecting transaction information, including all financial activities such as sales, purchases, and expenses. These transactions are then recorded in journal entries and posted to the general ledger.

After the journal entries have been posted, bank accounts are reconciled, and a trial balance is prepared to ensure that the debits and credits in the accounts are equal. Any discrepancies are then investigated and corrected. Once the trial balance is accurate, financial statements such as the income statement, balance sheet, and statement of cash flows are prepared to summarize the business’s financial performance and position.

The accounting cycle is completed within a specific period of time, which is typically a month, quarter, or year. The significance of the accounting period lies in its role in financial reporting, as it allows businesses to report their financial performance and position at regular intervals, providing stakeholders with timely and relevant information for decision-making.

9. Basic Bookkeeping Practices

Effective bookkeeping is essential for accurate accounting. Accuracy and attention to detail are crucial in recording transactions, as even small errors can significantly impact financial reports. This includes ensuring that all income and expenses are properly categorized and recorded, performing bank reconciliations, reviewing financial statements, and using accounting software to streamline processes.

Accounting software plays a crucial role in automating repetitive bookkeeping and accounting tasks, such as data entry and reconciliation. It can also generate financial reports and provide valuable insights into the business’s financial health. Additionally, the use of tools that integrate online sales platforms with accounting software can also simplify the bookkeeping process and enhance a company’s accounting software functionality. By automatically syncing online sales platforms with accounting software, businesses can ensure that all transactions are accurately recorded without manual input.

The connection process for recording transactions involves linking bank accounts and credit cards to the accounting software to track all financial activities. This allows for real-time monitoring of cash flow and balances, enabling timely decision-making. Ultimately, basic bookkeeping practices, when combined with accounting software and tools, can help streamline financial management processes and ensure accurate and up-to-date financial information.

Conclusion

Understanding basic accounting concepts is essential for students and anyone interested in the financial aspects of business. These fundamentals provide the groundwork for analyzing financial statements, making strategic business decisions, and managing finances effectively. As you delve deeper into each concept, you’ll appreciate the role of accounting in shaping successful businesses and responsible financial management.

In addition to understanding these basic accounting concepts, students will need to master some fundamental skills that are best developed with practice. For those eager to learn more, explore our self-paced, on-demand accounting resources for students.

We hope this blog helps you better understand basic accounting concepts integral to success in accounting classes.