Accounting is a popular major for students interested in a steady, reliable job with numerous career opportunities. Many students are drawn to an accounting career for its promise of stability and growth. However, before committing to a major in accounting, it’s essential to gain a deeper understanding of what it entails, its challenges, and the evolving landscape of this profession.

For example, the field of accounting offers numerous benefits, including the ability to choose between working in the public or private sector, as well as the opportunity to work in a more business-oriented role. But it also requires the ability to interpret and apply complex financial regulations, adhere to a professional code of conduct, and pay attention to details. In this article, we will cover what you should know before majoring in accounting.

What You Should Know Before Majoring in Accounting

1. Degree Requirements for Accounting Majors

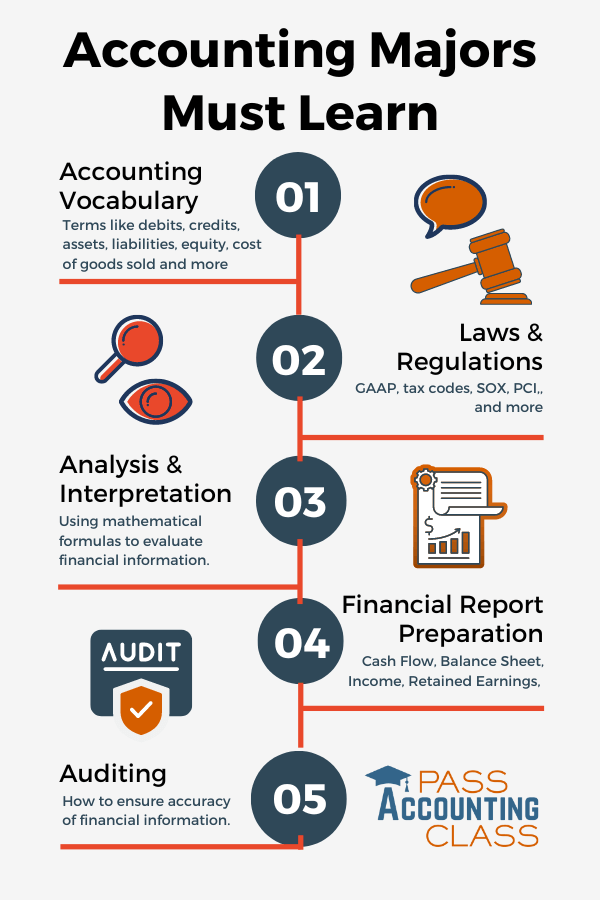

Accounting, at its core, involves measuring, processing, and communicating financial information. So majoring in accounting means you’ll be learning:

- A New Vocabulary: The accounting industry has a language all its own – with terms like credits, debits, cost of goods sold, assets, liabilities, equity, and so much more.

- Laws and Regulations That Apply to the Accounting Industry: such as Generally Accepted Accounting Principles (GAAP), tax codes, and other financial regulations.

- Analysis and Interpretation of Financial Information: Using mathematical formulas to evaluate various aspects of the financial health of a business.

- Preparation of Financial Statements: These statements help management, regulators, and other stakeholders understand a company’s financial status.

- How to Conduct Audits to Ensure the Accuracy of Financial Data

As a result, core skills and competencies required for success in accounting include proficiency with advanced math topics (algebra, statistics), attention to detail, analytical thinking, strong communication skills, proficiency in accounting software, and the ability to interpret and apply complex guidelines, rules, and regulations.

The first-year accounting curriculum is typically comprised of:

- Financial accounting, which focuses on preparing financial statements for external stakeholders and

- Managerial accounting, which involves providing financial information for internal decision-making.

Different branches or specializations within accounting include financial accounting, managerial accounting, auditing, taxation, and forensic accounting. Each specialization requires a specific skill set and knowledge to succeed in the field.

2. Career Prospects in Accounting

Interested in the world of finance and numbers? Pursuing a career in accounting can open up a wide array of job opportunities. From becoming a public accountant to specializing in financial management, a degree in accounting can lead to various roles in industries such as banking, investment, and corporate finance. Whether you aspire to become a financial officer, business analyst, advisor, or even a business lawyer specializing in finance, there are plenty of career opportunities to explore with a degree in accounting.

3. Challenges and Misconceptions

Common misconceptions about studying accounting include believing it is a boring and tedious subject or only involves number-crunching. In reality, accounting is a dynamic field that involves critical thinking, problem-solving, and decision-making.

Every day, I work with students – good students – who are struggling with their accounting classes, and the most common challenges they share are:

- “I thought I understood the material, but then I took the test and didn’t do well.”

- “It seemed so easy in the beginning, but now I’m lost.”

- “I feel rushed to complete the test, or I run out of time.”

What students don’t realize is that accounting classes are like math classes and foreign language classes combined. On top of that, subsequent lessons build on previous lessons. So you can get lost quickly if you don’t get help immediately.

Other potential challenges include the complexity of the subject matter, the heavy workload, and the need for attention to detail. Additionally, some students may struggle with the transition from theoretical knowledge to practical applications.

These challenges and misconceptions can be overcome and corrected by seeking extra support through tutoring or study groups and gaining real-world experience through an accounting internship or part-time work. Accounting majors can also benefit from joining accounting clubs or professional organizations to network and gain insights into the industry.

Additionally, learning how to study for accounting classes, staying organized, and effectively managing time can help students handle the heavy workload while seeking feedback and guidance from mentors can aid in mastering the practical aspects of accounting. At Pass Accounting Class, we specialize in helping students successfully navigate the study of accounting and prepare for a fulfilling career in the field.

4. Academic and Professional Requirements

Accounting jobs typically require a Bachelor’s degree in accounting for entry-level positions, but advanced degrees and certifications are often necessary for career advancement. (Source: Bureau of Labor Statistics) Important certifications accounting graduates should consider include:

- Industry Certifications like the CPA (Certified Public Accountant), CFA (Certified Financial Analyst), CMA (Certified Management Accountant), CIA (Certified Internal Auditor), or CFE (Certified Fraud Examiner)

- Accounting Software Certifications like QuickBooks ProAdvisor certifications

- Advanced Degrees such as a Master’s degree or Ph.D.

Relevant work experience also adds value to a career in accounting and opens up opportunities for advancement in the field. For example, gaining professional hands-on experience through internships is essential for developing the necessary skills and knowledge in the field. This can also help secure future job opportunities and build a professional network.

Continuing education and staying updated on industry regulations and trends is also important for accountants to maintain their licenses and certifications. Overall, a combination of education, certification and licensing, professional experience, and ongoing professional development is vital for a successful career in accounting.

5. Skills and Traits Needed for Success

In order to succeed in accounting, students must possess strong mathematical skills and a solid foundation in algebra, statistics, and calculus. A deep understanding of these mathematical concepts allows students to accurately analyze financial data, make informed decisions, and effectively apply accounting principles. Beyond numbers, essential skills such as communication, analytical thinking, and attention to detail are crucial for success in the field.

Accounting students can develop these skills throughout their course of study by actively engaging in practical application of mathematical concepts, participating in communication training and workshops, and seeking internships and work-study programs that provide opportunities to analyze real-world financial data.

6. Industry Trends and Technology

In the accounting field, technology has had a significant impact on the way businesses operate. Current industry trends show a shift towards cloud-based accounting software, which has streamlined processes, improved accuracy, and increased efficiency. This technology development has directly impacted the market, as businesses can now access real-time financial data and make more informed decisions. Consumer behavior has also been influenced, as clients now expect quicker and more transparent financial reporting.

Recent advancements in the accounting industry include using artificial intelligence and machine learning to automate repetitive tasks, such as data entry and reconciliation. Additionally, blockchain technology has gained traction for its ability to provide a secure and transparent ledger of transactions. By staying updated with these technological advancements, accounting professionals can improve their services, provide better value to their clients, and stay ahead of the competition.

Overall, the importance of staying updated with technological advancements in the accounting field cannot be overstated. Embracing new technologies and updated practices ensures that professionals remain competitive, relevant, and able to meet the evolving needs of their clients.

7. Financial Considerations

Pursuing an accounting degree can be expensive, including tuition, textbooks, tutoring, certifications, and licenses. The cost of an undergraduate degree can range from $38,800 to over $155,200, depending on the institution and location. (Source: National Center for Education Statistics)

However, there are various opportunities for financial assistance. Many colleges and universities offer scholarships and grants specifically for accounting students. Additionally, students may be eligible for federal financial aid such as grants, work-study programs, and loans to help offset the cost of education.

Despite the initial investment, obtaining a degree in accounting may lead to a strong return on investment. Accountants generally enjoy above-average salaries, job security, and a positive employment outlook. According to the Bureau of Labor Statistics, the median annual wage for accountants and auditors was $78,000 in May 2022. The demand for accountants is expected to grow by 4% from 2022 to 2032, which is as fast as the average for all occupations.

Overall, while pursuing an accounting degree may require a significant financial investment, the potential return in terms of salaries and job security makes it a worthwhile long-term investment.

How to Choose the Right Program and Degree for You

When choosing an accounting degree program, it’s important to consider the potential benefits and specific curriculum offered.

A bachelor of science in accounting provides a strong foundation in accounting principles and prepares students for entry-level accounting positions. This program often includes courses in financial accounting, managerial accounting, auditing, and taxation. Practical experiences such as internships are valuable in providing real-world exposure and opportunities to apply classroom learning.

A bachelor of science in accounting and finance combines accounting principles with a deeper focus on financial management and investment analysis. This degree can lead to roles in corporate finance, budget analysis, and financial planning. Students may take courses in financial statement analysis, corporate finance, and investment strategies.

A master’s degree in accounting is for those looking to advance their career in accounting and pursue opportunities in taxation, auditing, or financial management. The curriculum includes advanced accounting topics and research methods and often involves a capstone project or thesis. A master’s degree can lead to leadership roles and increased job opportunities within a wide variety of industries. Internships may also be offered to gain practical experience and network with professionals in the industry.

Ultimately, choosing the right program and type of degree depends on career goals and interests within the accounting profession.

Advice from Professionals and Alumni

As professionals in the accounting industry, the following pieces of advice from leaders and alumni have proven to be invaluable:

“Stay curious and always be willing to learn. The accounting field is constantly evolving, and those who are open to new ideas and technologies will thrive.”

Jenna Smith, CPA

“Don’t underestimate the power of networking. Building relationships and connections within the industry can open up opportunities that you may not have even considered.”

David Nguyen, Financial Analyst

“Attention to detail is critical in accounting. Be diligent in your work and always double-check your numbers to avoid costly mistakes.”

Sarah Johnson, Forensic Accountant

“Seek out opportunities for professional development and continuing education. The more knowledge and certifications you acquire, the more valuable you become to employers.”

Mike Chen, Tax Consultant

“Maintain a strong ethical compass in all of your dealings. Trust and integrity are at the core of the accounting profession, and they are essential for long-term success.”

Rachel Thompson, Auditor

These professionals all emphasize the importance of continuous learning, networking, attention to detail, ongoing professional development, and ethical conduct. Their collective wisdom highlights the recurring theme of adaptability and integrity in the accounting field.

Conclusion

In conclusion, a career in accounting offers a variety of career paths and rewards, including job stability, competitive salaries, and opportunities for advancement. Continued education is crucial in this field, as it allows professionals to stay updated on the latest industry trends, regulations, and technology. Specialization within the industry is also pivotal, as it allows accountants to focus on specific areas such as forensic accounting, managerial accounting, or taxation. This can lead to increased job prospects, higher salaries, and enhanced job satisfaction. Overall, the accounting field provides a wide variety of opportunities for growth and development, making it a rewarding and promising career choice for individuals with a strong aptitude for numbers and a passion for financial analysis.