Preparation is the key to success when trying to pass your accounting class. The best way to prepare for your next accounting test or quiz is to work on accounting problems you’re likely to see on your test. This free accounting principles practice test assesses your knowledge of some of the most common questions that students encounter on their accounting exams. It will help you quickly identify your strengths and focus your efforts on where you need more study and practice.

Accounting Principles Practice Test

- Which accounting principle/assumption is illustrated when a company’s Balance Sheet displays the original cost of a building instead of the market value?

- Going Concern Principle

- Cost Principle

- Monetary Unit Assumption

- Matching Principle

- Which accounting principle/assumption is illustrated when a company accrues expenses?

- Going Concern Principle

- Cost Principle

- Revenue Recognition Principle

- Matching Principle

- Which accounting principle/assumption is illustrated when a company accrues revenue?

- Going Concern Principle

- Cost Principle

- Revenue Recognition Principle

- Matching Principle

- A Prepaid Expense account is a(n)

- Asset Account

- Liability Account

- Expense Account

- Revenue Account

- An Unearned Revenue account is a(n)

- Asset Account

- Liability Account

- Expense Account

- Revenue Account

- Which accounting principle/assumption assumes that a business will remain in operation for the foreseeable future?

- Going Concern Principle

- Cost Principle

- Revenue Recognition Principle

- Matching Principle

- Which accounting principle/assumption states that when there’s an option in reporting a transaction, you should use the option that results in lower asset amounts and/or lower net income.

- Going Concern Principle

- Cost Principle

- Conservatism Principle

- Matching Principle

- Which accounting principle/assumption states that a business should only record economic events that can be expressed in a unit of currency.

- Going Concern Principle

- Monetary Unit Assumption

- Conservatism Principle

- Economic Entity Assumption

- Which accounting principle/assumption states that a business should only record economic events that can be expressed in a unit of currency.

- Going Concern Principle

- Monetary Unit Assumption

- Conservatism Principle

- Economic Entity Assumption

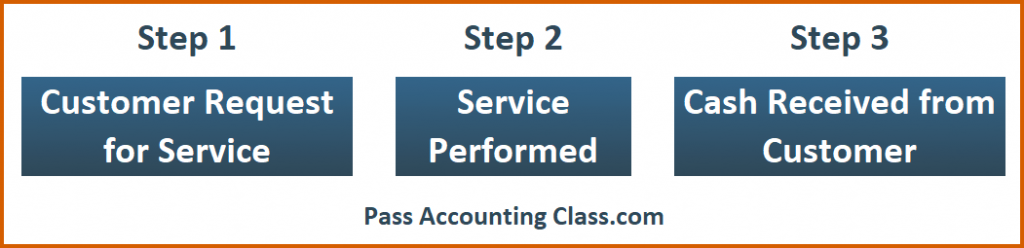

- Using the picture below, according to the Revenue Recognition Principle, when should you record revenue?

- Step 1

- Step 2

- Step 3

Answer Key:

- Cost Principle

- Matching Principle

- Revenue Recognition Principle

- Asset Account

- Liability Account

- Going Concern Principle

- Conservatism Principle

- Monetary Unit Assumption

- Economic Entity Assumption

- Step 2

Need Help with Accounting Principles?

So, how did you score on the accounting principles practice test above? More importantly, did you really know the answers, or did you have to guess at some of the questions? Ideally, you should be able to answer those accounting questions with ease. If you can’t, you may want to get some more accounting practice.

You can read up on accounting principles in this post, but the best practice is actually working through accounting quiz questions. You see, basic accounting principles can be confusing, but they don’t have to be. As I mentioned earlier, preparation is key. If you want to find out how to quickly and easily solve these accounting problems, check out our Pass Accounting Class Resources.

There’s no need to feel confused about these basic accounting principles or stressed out because you feel like there’s never enough time to finish all the questions on your accounting quizzes and tests. My students efficiently solve accounting problems with confidence in the allotted time. and I can show you how to do this too with Pass Accounting Class Resources.