Most Difficult Accounting Principles

In this post, we’ll take a look at the 3 most difficult accounting principles for students. We looked at some generally accepted accounting principles (GAAP) in this post. In that post I provided a GAAP definition and answered the question, “what is GAAP?” In summary, these basic accounting principles guide accountants on how to properly treat accounting transactions. Additionally, they help with financial statement preparation. Many people who don’t know what the term actually stands for often mistakenly use “GAPPS” instead of its proper acronym “GAAP.”

Generally accepted accounting principles are often referred to as US GAAP. Non-US companies use the International Financial Accounting Standards (IFRS). The International Accounting Standards Board (IASB) issues IFRS. IFRS look to accomplish a similar goal to GAAP, they just approach it differently. IFRS replaced older standards in 2001 called International Accounting Standards (IAS). Thankfully, most first year accounting classes in the US mention IFRS but usually don’t require students to learn IFRS.

GAAP principles aren’t necessarily hard to understand, but a lot of students struggle with understanding how to apply the principles. This is an issue because they struggle when asked “What principle is this?” on test questions illustrating common accounting scenarios.

Why Are Some Accounting Principles Difficult to Understand?

It’s easy to memorize information without truly knowing the information. By that I mean, you can memorize an accounting principle and the definition. Hopefully, you’ll only see a definition question on your test. Chances are you’ll see a test question that relates to the application of the principle. This is one of the reasons accounting principles are challenging. As a student new to accounting, a lot of the ideas are completely foreign to you. While learning the principle name and definition is a good start, it may not be enough. Application of the principle is key and students usually struggle with applying the principles.

Since the “language” of accounting is new to you, it’s easy to get confused because some of the principles seem similar. It’s like the principles blend together and/or overlap. This makes it even more difficult to distinguish between the principles. For example, we’ll review the Revenue Recognition Principle and the Matching Principle below to see how they blend together and overlap.

Revenue Recognition Principle

The Revenue Recognition Principle states that you should record revenue only when it’s been earned, regardless of payment received or not received. So, how do you know when revenue is earned? This question is the key to effectively applying this principle. Once you’ve figured out when revenue is earned, you’ll need to use the proper accounts. A lot of students get confused with this principle and mistakenly record transactions to the wrong accounts.

Service Revenue, Unearned Revenue, Cash, and Accounts Receivable are some accounts that relate to applying this principle properly, but you have to know when to use these accounts. Sometimes students think that if you receive Cash for services to be performed, it’s recorded as Service Revenue. But that’s not the case.

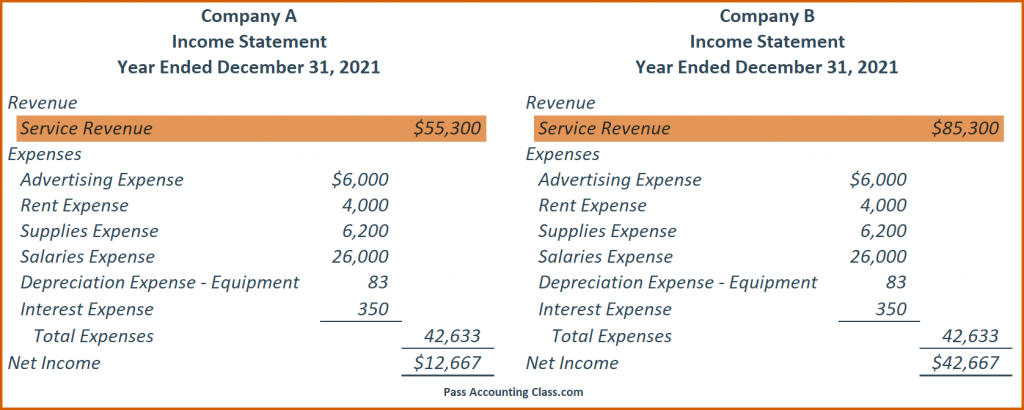

For example, two identical companies with identical transactions each receive $30,000 for services to be performed. Company A records the transaction applying the Revenue Recognition Principle and Company B does not. As illustrated in the example Income Statements below, applying this principle incorrectly results in misleading financial statements (Company B).

Matching Principle

The Matching Principle works closely with the Revenue Recognition Principle. It states that you should record a related expense when you record a revenue. So, when do you record a revenue? See the Revenue Recognition Principle above :-). The Matching Principle deals with Prepaid Expenses and Accrued Expenses. Understanding the Matching Principle helps when preparing adjusting entries.

Just like with the Revenue Recognition Principle, students get confused as to when they should record an expense. Recording expenses too early results in an understated Net Income. Recording expenses too late results in an overstated Net Income. As you can imagine, applying this principle incorrectly results in misleading financial statements.

Economic Entity Assumption

The Economic Entity Assumption states that a business is a separate entity from the owners. A lot of students struggle with this when trying to understand initial capital contribution, owner withdrawals, common stock sale, distributions, and retained earnings. A lot of accounting classes start with transactions for starting a company. Transactions associated with entity ownership are easier to understand if you remember that the business is separate from it’s owners.

Test your knowledge with this free Accounting Principles Practice Test.

Get Help with Accounting Principles

GAAP accounting concepts can be confusing, but they don’t have to be. I’m here to help you succeed. I’m here to help you pass accounting class! There’s no need to feel confused about these basic accounting standards or stressed out because there’s never enough time to finish all the questions on your accounting quizzes and tests. My students efficiently solve accounting problems with confidence in the allotted time. And you can learn how to do this with Pass Accounting Class Resources.

Pass Accounting Class Resources is THE place students go for on-demand video tutorials with step-by-step solutions to common homework problems, practice quizzes and test prep, and more.